Andrew Usher, Director of Catand Advisory, explains how a value can be placed on a pest control business based on revenue data.

I like to compare selling a business to selling a home. Would you present your home to prospective buyers with your kids’ toys lying around or with the laundry looking like it does on most days? No – you would put away the everyday items and present the home in a manner that allows the buyer to see themselves living in it. The same applies to a business.

The key financials for a business valuation are revenue and profit. Put simply, the higher the revenue, (and hopefully) the higher the profit – the greater the value of the business. In considering both of these, the word ‘sustainable’ is key. Are these values sustainable? Is ongoing revenue (and profit) likely to remain the same after the sale of the business?

The term we use to value a business is ‘valuation multiple’. A valuation multiple is a ratio – a valuation of a business relative to a key financial metric. For example, 2 x revenue or 4 x profit before tax.

For a pest control business, there are many factors that affect this valuation multiple. Firstly, the type of pest work being carried out, whether it’s primarily residential, contracted or commercial revenue. Secondly, termite management systems – how many are currently in the service schedule and for what length of time have they been held? Thirdly, retention rates of clients and the systems and processes in place that work to retain those clients. Lastly, the number of potential avenues for new business and the marketing strategies currently in use to maximise growth.

Let’s look at business valuations based on revenue (which excludes GST). For potential buyers, the size of a business is a critical factor when considering revenue. A one-man operation turning over $300k in revenue cannot be valued the same as a business turning over $3 million revenue. The one-man business is solely dependent on the business owner, which means it is almost impossible to transfer all the clients to a new owner; the business is built on the personal relationships between the owner and their clients. Once the owner is out, many clients will almost immediately consider seeking an alternative pest control provider, as they don’t know the new owners.

A business of $3 million obviously employs a number of people, so the transition of the employees to the new owners is a key step in the sales process and a very important consideration for the potential acquirer. We have all heard of technicians saying “I will never work for that person” which leaves the $3 million business with a new owner, but no employees – so it really has no revenue!

Whilst cash payments may not be significant these days, they still exist. Telling a prospective buyer that you took $50,000 in cash with no record means nothing. If income cannot be proven, it tends to be disregarded when preparing a valuation. It is always best to process all invoices the same way, whether cash, cheque, EFT or card payments. This way, no questions are raised nor considerations given regarding the accuracy of revenue. It should tie into all business administration systems, tax records and bank statements.

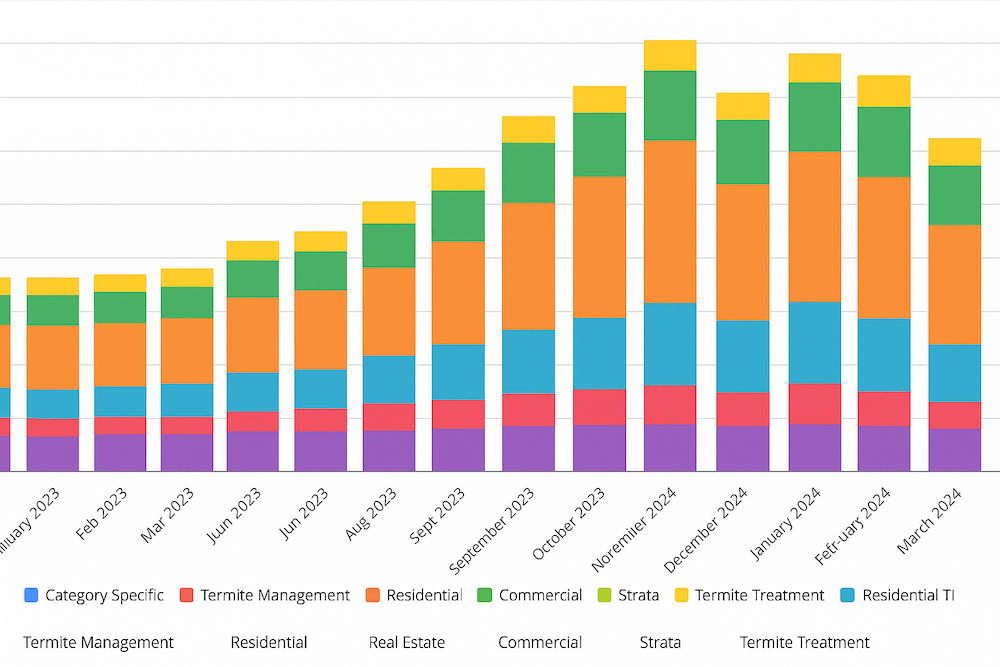

Similarly, a database or accounting system – such as Formitize, ServiceM8, MYOB or Xero – is important to show correct processes and practices in terms of client data and client revenue/retention. The day of filing cabinets full of client files are truly a thing of the past and make it impossible to accurately and easily analyse your data. Accessing revenue figures from a database is also easier to manipulate when analysing data and ensures that any prospective acquirer can load this data into their own systems as well (Figure 1).

Business data will be analysed throughout the acquisition process, to ascertain whether the revenue figure is sustainable going forwards. Items that are likely to be examined include: revenue by client (commercial vs residential); top ten clients by revenue (to determine the level of dependence on any specific client); retention rates of clients; revenue profiling by month (summer vs winter); revenue by service stream (termite vs general pest); and average job value vs customer price lists.

So what would be an indicative valuation multiple based on revenue? From past experience, I would suggest that an owner-operator business with annual revenue of $300k and business operations in good order should consider any offer slightly under a dollar for dollar price (1 x revenue) as a reasonable offer and negotiate with a prospective buyer. A walk in/walk out price – when the owner leaves the business immediately after acquisition – is likely to be less than one where you offer to stay and work with the buyer to ensure that all clients/revenue transfers to them.

For a business making around $3 million per year, you are probably looking in the range of 1-2 x revenue (depending on what is happening in the market at the time). Again, this is not a simple rule as there are other factors impacting this price such as the condition of your vehicles and equipment, whether similar businesses to yours are selling at the same time, etc.

If you’re considering selling your pest control business, now’s the time to ensure that clear customer retention processes are in place and that the revenue data is easily accessible via business management and accounting software. In my role as a broker, I work with pest management businesses to help present a clear picture of their financials. Ultimately, working with a professional can guide you through the valuation and sales process and maybe explain why the market is ‘different’ at a particular time, leaving you with the option of selling your business now versus maybe waiting a little longer to potentially get more value.

Andrew Usher, Director, Catand Advisory